- Our Blog

Download PDF

The optimal time to invest is sometimes unclear. But dollar-cost averaging helps remove the guesswork.

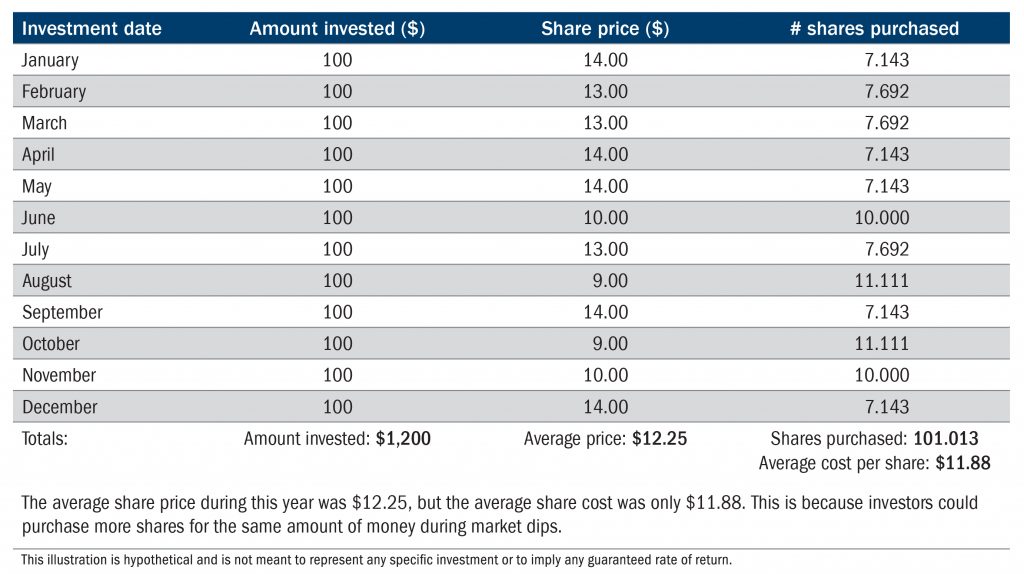

Dollar-cost averaging is the practice of investing a fixed dollar amount at regular intervals, and it can be an effective strategy for investors — especially during periods of market ups and downs. Having a disciplined strategy in place can help investors avoid emotional reactions to temporary market movements. And over time, the average cost per share will usually be lower than its average market price. Here’s how it works:

To put it simply: More shares are purchased when prices are low, and fewer shares are bought when prices are high. As a result, dollar-cost averaging may lower your overall cost per share while you accumulate more assets.

Bottom line

Investors who invest only when the market is up are always buying high. By sitting on the sidelines when the market declines, investors fail to benefit from purchasing stocks when they’re effectively on sale. Adopting dollar-cost averaging can help investors maintain discipline and usually results in a lower average cost per share.

Download this article as a PDF