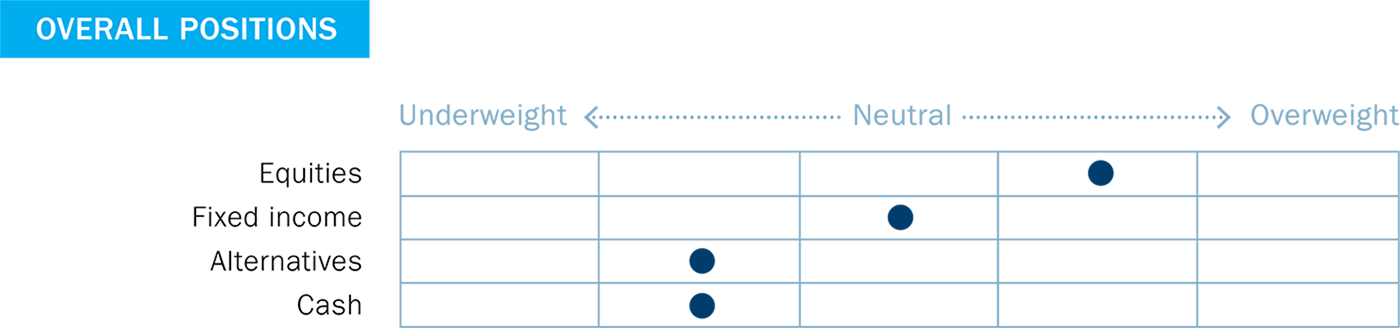

A snapshot of our current views on equity, fixed-income and alternative asset classes — updated monthly to help you tactically adjust for opportunities and risks.

-

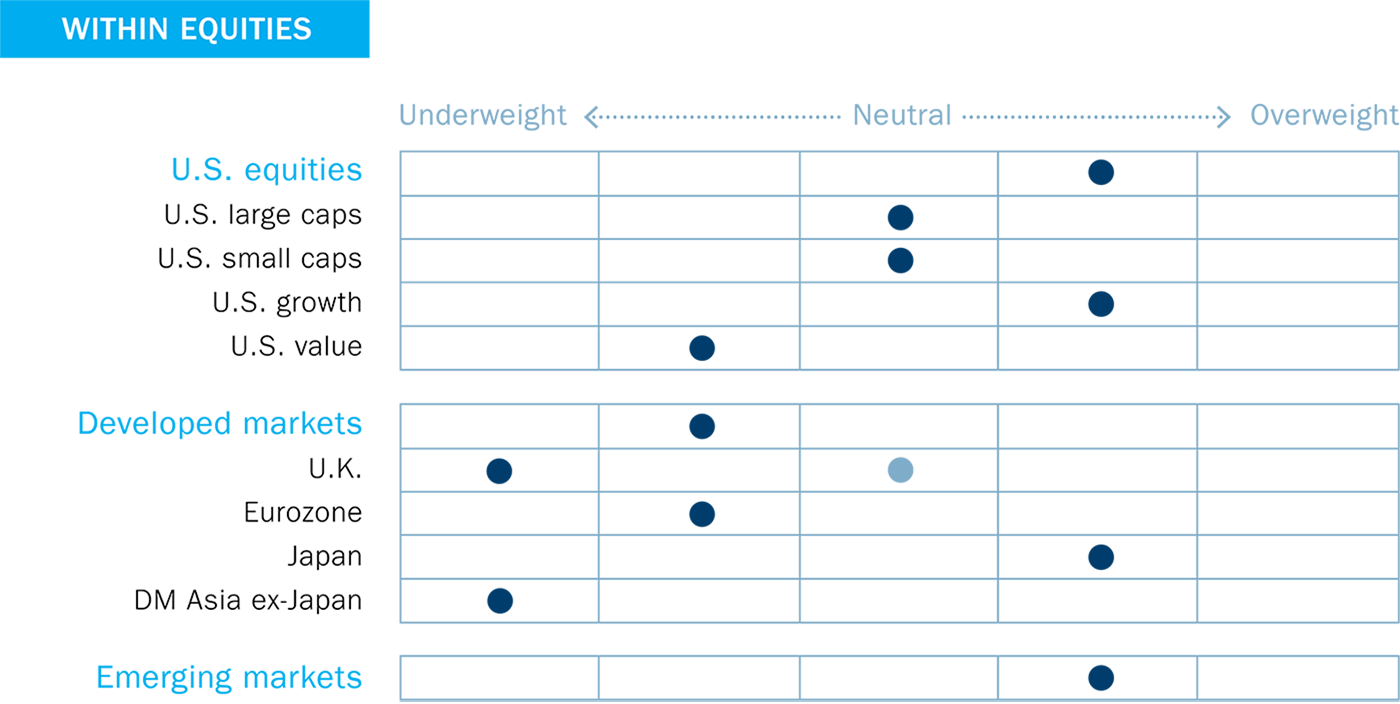

U.S. equities continue to be a preferred asset class as we believe strong momentum in prices and earnings, as well as low volatility, outweigh the negative of lofty valuations.

-

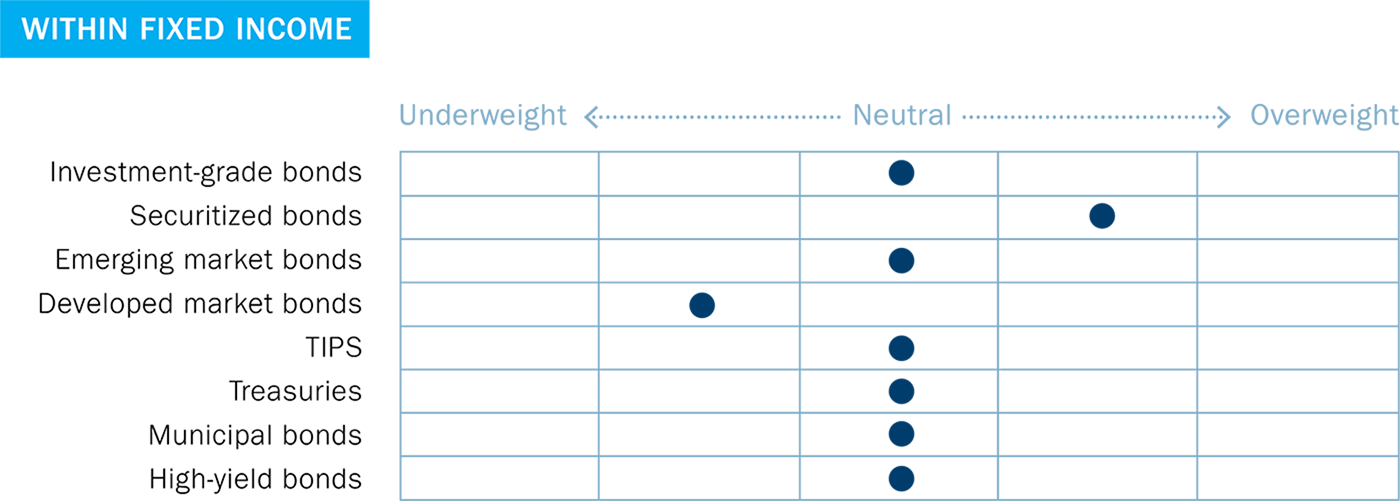

We maintain our neutral position on fixed income, with an overweight to securitized assets. While rate cuts are still being priced in for 2024, the magnitude and timing remain uncertain.

-

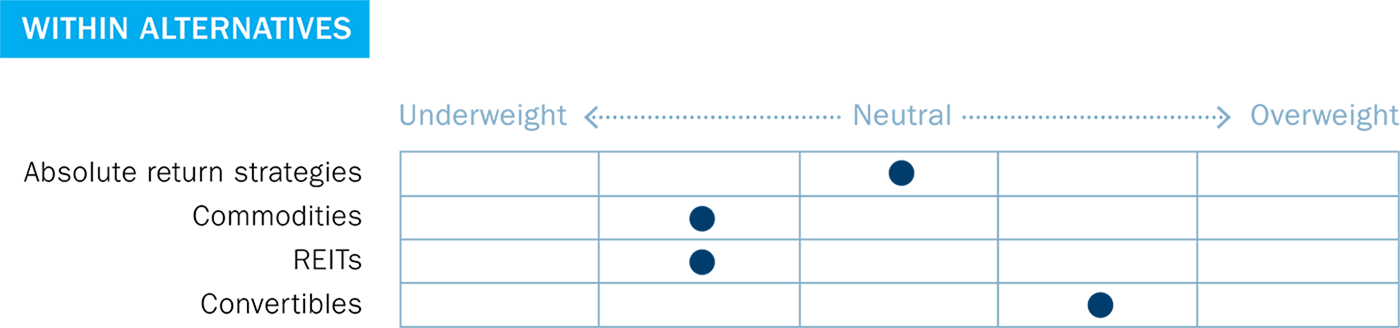

We continue to believe in the diversification benefits of including alternatives in a portfolio but maintain our underweights to inflation-sensitive areas such as REITs and commodities.