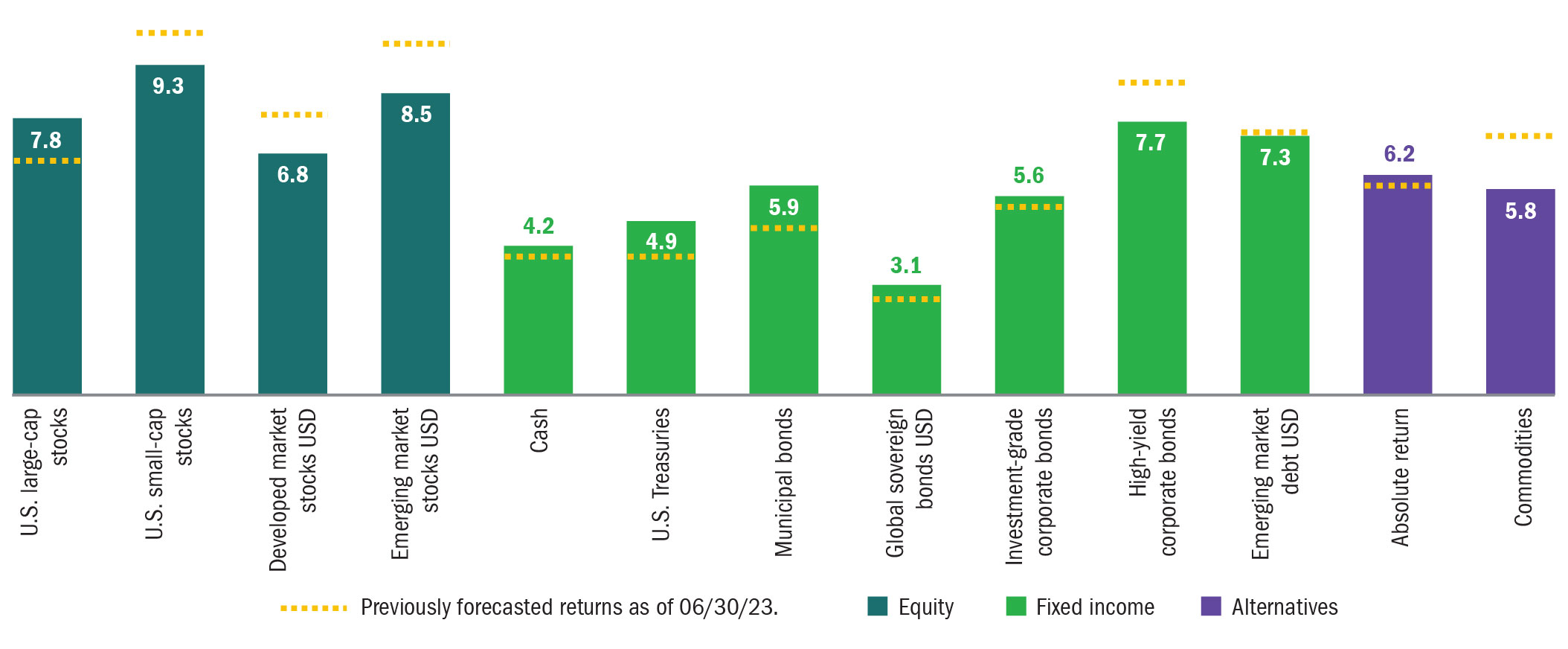

A five-year returns forecast for major asset classes — updated twice a year to help you set strategic portfolio allocations.

- We’ve raised forecasts on U.S. large-cap stocks due to a rise in expected dividend and buyback activity, and we've reduced forecasts on U.S. small-cap stocks because valuations have come closer to long-term history.

- We’re seeing improved growth and inflation estimates for non-U.S. developed and emerging market equities, but we expect valuations to be flat for developed markets and a detractor to returns for emerging market equities.

- In fixed-income markets, yields are higher since our mid-year update except for riskier markets such as high yield and emerging market debt. This increase in yields has boosted expected returns in cash, Treasuries and investment-grade bonds. Conversely, tighter yield spreads between high yield and emerging market bonds versus U.S. short-term rates, and an increase in the expected default rates for these two markets, has resulted in a lower five-year outlook.

- While we have again slightly upgraded our expected returns on cash for the next five years, an inverted U.S. yield curve and the potential for the Federal Reserve to initiate rate cuts both act as headwinds, especially on short-term rates.

Forecasted five-year total average returns (%)*

Strategic outlook: We started the year with equal probabilities for a recession or a soft landing and a small chance (20% probability) given to beating consensus growth estimates. For this update, we’ve streamlined our forecast approach to use a baseline scenario that incorporates our most probable growth and inflation expectations.

- Since our last update, the outlook on the macro economy has generally improved. Consensus estimates on U.S. and global growth for 2024 are higher and recession risks are lower.

- Many countries, including the U.S., have started seeing their inflation measures turning over from recent highs, and we expect most central banks to be at or nearing the end of their hiking cycles.

- However, the stickiness of higher rates may challenge riskier credit markets (even more than any increases in defaults or credit downgrades). Additionally, the recent surge in stock prices in an environment with low volatility and high bond yields traditionally challenges valuation growth and potential stock returns.

- While lowered inflation expectations are generally good for most capital markets, forecasted returns in commodity markets are now lower.