Navigate Rates

Investment risks, such as changing interest rates, may present opportunities for fixed-income solutions. Consider a non-traditional approach for navigating interest rates with Columbia Threadneedle Investments.

Predicting how and when interest rates will change can frustrate investors and leave advisors uncertain on a strategy. Instead of viewing fluctuations as an obstacle to your clients’ goals, consider them an opportunity. We’ve created a non-traditional strategy to endure changing rates and thrive in all markets — helping you navigate today's fluctuating market and guide your clients toward success.

Four major risk factors

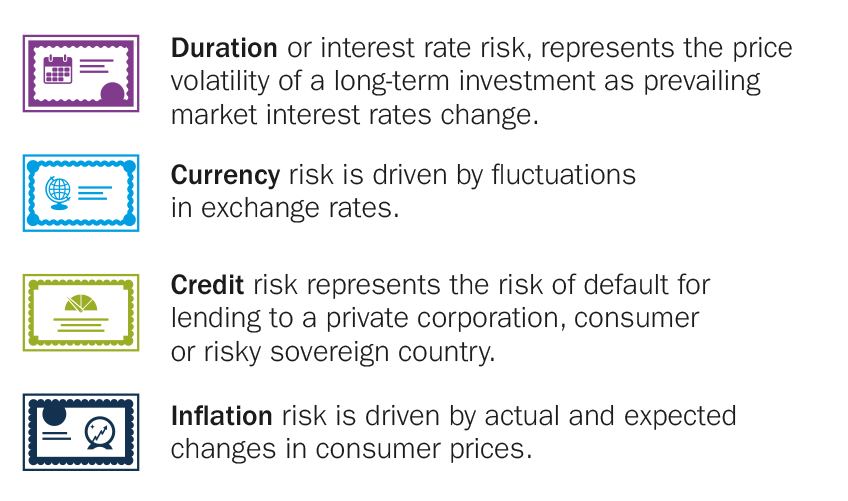

What is a risk factor?

Before we can get into strategies for building better portfolios, we first need to review the major types of risk factors that drive fixed-income performance.

A risk factor is an independent market variable that helps explain the return of an investment. While "risk" often carries a negative connotation, here it equally represents positive return potential. In the bond market, while there are many risk factors that drive performance, we find four dominant risk factors:

Duration, credit, inflation and currency risk are all drivers of fixed-income performance, and they affect investments differently. We believe that a multi-sector approach that capitalizes on all four risk factors may lead to better or more diversified outcomes across market cycles. In each case below, one of the four risk factors dominates the overall risk profile, which subjects investors to a narrow range of potential outcomes.

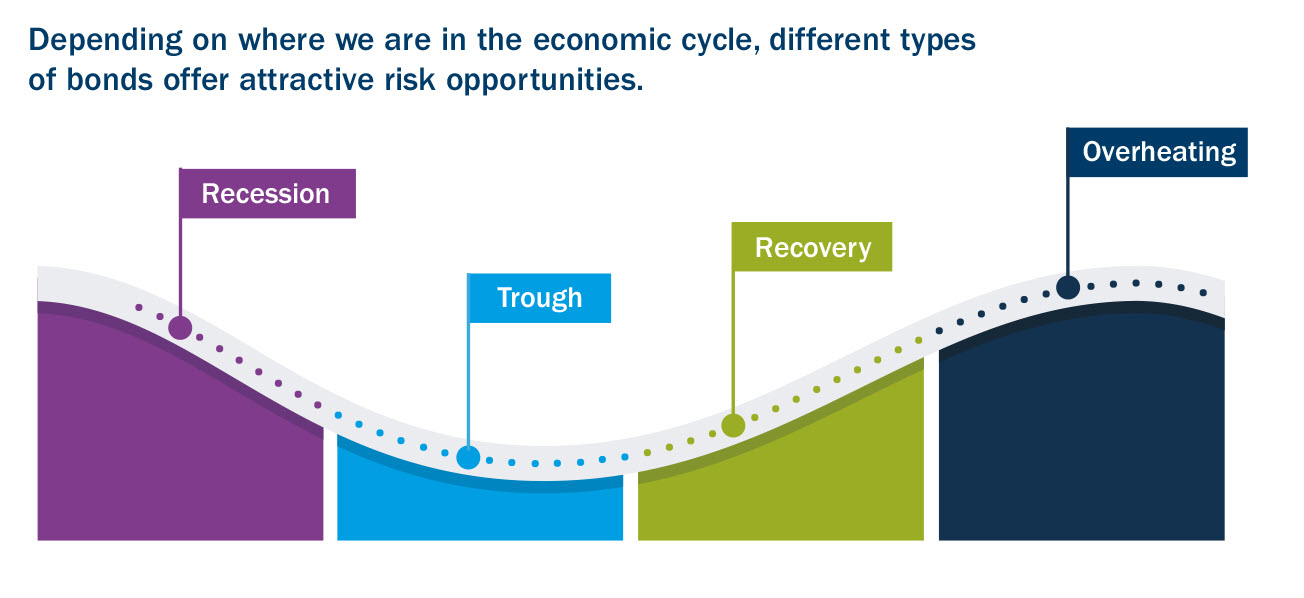

For a closer look at when these risks are most and least attractive, read our white paper, Harnessing Fixed-Income Returns Through the Cycle (PDF).

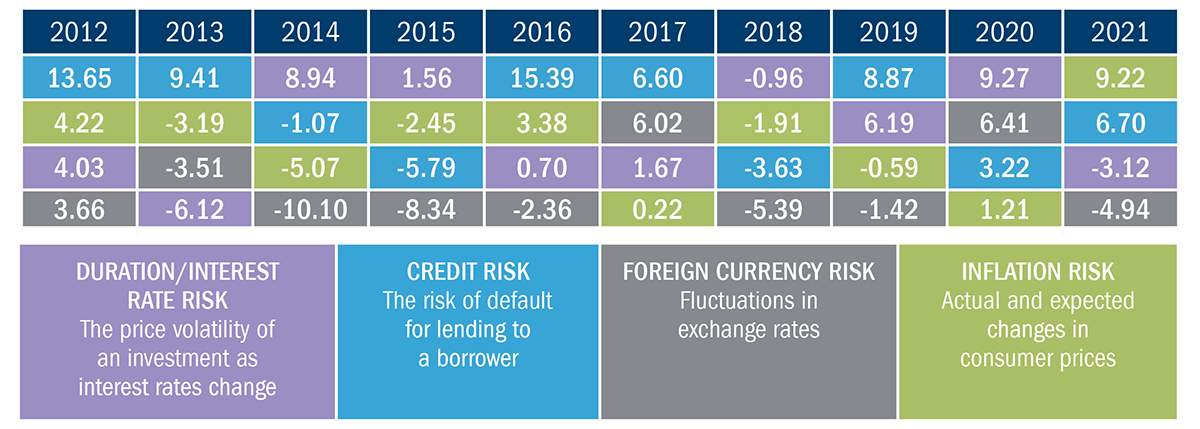

Risk factors deliver positive performance returns at different times

Performance across sectors can generally be attributed to four major performance drivers: duration, credit, currency and inflation. Each driver behaves differently depending on what’s going on in the market. A fixed-income strategy that takes a flexible approach is set to capture the return possibilities of the strongest driver in each market.

Past performance does not guarantee future results.

When can risk mean opportunity?

We believe that understanding the four risk factors lays the foundation for successful, strategic bond market investing. Because these factors are not highly correlated, they can provide diversification benefits in a portfolio when used together. Since each risk factor is unique, they produce positive returns in different periods throughout market cycles, creating opportunities for investors to emphasize different risks at different times and in different market environments.

By breaking bonds down to their most basic components, today's investors can gain a better understanding of the factors that generate risk and return. A better understanding of these drivers can help investors navigate the current market and build bond portfolios that can generate attractive returns through the cycle.

Solutions for Navigating Interest Rates

Columbia Strategic Income Fund

Morningstar Category: Nontraditional Bond

Target competitive income and appreciation by investing in a flexible fixed-income strategy that adapts to changes in credit risk, inflation levels, currency valuations and interest rates.

Columbia Strategic Municipal Income Fund

Morningstar Category: Muni National Long

Target total return, consisting of tax-exempt income and capital appreciation, with a strategy that uses a flexible investment approach.

Columbia Total Return Bond Fund

Morningstar Category: Intermediate Core-Plus Bond

Target total return, consisting of current income and capital appreciation, with a flexible and diversified-core-plus portfolio of high-quality bonds and the potential to invest in high-yield securities.